| About |

| The Results Wave 28 Wave 27 Wave 26 Wave 25 Wave 24 Wave 23 Wave 22 Wave 21 Waves 11-20 Waves 1-10 |

| Working Paper Series |

| Related Research |

| Authors |

| Sponsors |

| FAQ |

| Contact |

| Press Room |

|

The Results: Wave 2

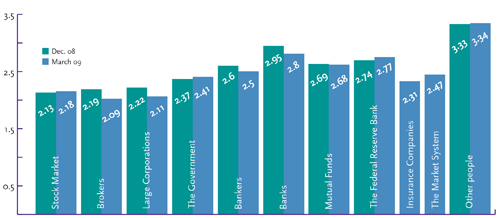

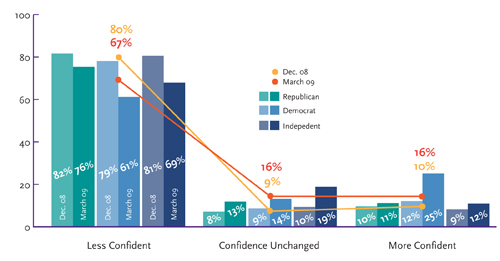

Paola Sapienza and Luigi Zingales1 April 8, 2009 - With a new plan to deal with the financial crisis and an aura of goodwill surrounding the first days of Barack Obama’s presidency, trust in the stock market made slight gains in the first quarter of 2009, according to the most recent findings in the Chicago Booth/Kellogg School Financial Trust Index. In contrast, trust toward banks and large corporations has continued to decline in the last three months, following recent headlines of corporate layoffs, executive bonuses, and banking disasters. The researchers found that from Dec. 2008 to March 2009, the Financial Trust Index has dropped slightly from 20 percent to 19 percent, with its subcomponents showing distinct shifts in trust in both directions. FINANCIAL TRUST INDEX: KEY FINDINGS Seeking to formalize the relationship between trust and finance, Sapienza and Zingales analyzed data from more than 1,000 American households, randomly chosen and surveyed via phone during two weeks in late March 20092. This wave is a follow-up to the inaugural Jan. 2009 findings.

Stock Market "We discovered clear signs that trust in the stock market has gone up in all areas that we measure, such as a higher willingness to invest, higher expectations on returns, and lower expectations that the stock market will drop significantly,” said Zingales. “In a short amount of time, this shows growth in overall confidence in the market, however slight.”

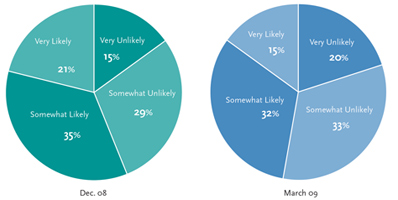

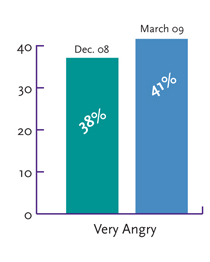

Banks and Large Corporations At the same time, Sapienza and Zingales point out a substantial decrease in trust toward banks, from 34 percent in Dec. 2008 versus 29 percent in March 2009, and in large corporations, from 12 percent to 10 percent over the same time period. “The drop in trust toward banks and large corporations appears to be consistent with the negative publicity they’ve experienced in the first quarter of 2009,” said Sapienza. “This tarnished image, especially of banks, could impact their value moving forward in terms of rebranding and attracting new customers.” Government Intervention

1 Paola Sapienza is a Professor of Finance at the Kellogg School of Management at Northwestern University and Luigi Zingales is the Robert McCormack Professor of entrepreneurship and finance at the University of Chicago Booth School of Business. 2 The survey was conducted using ICR's weekly telephone omnibus service. It used a fully replicated, stratified, single-stage random-digit-dialing sample of landline telephone households |

|||||||||||||||||||||