| About |

| The Results Wave 28 Wave 27 Wave 26 Wave 25 Wave 24 Wave 23 Wave 22 Wave 21 Waves 11-20 Waves 1-10 |

| Working Paper Series |

| Related Research |

| Authors |

| Sponsors |

| FAQ |

| Contact |

| Press Room |

|

The Results: Wave 19

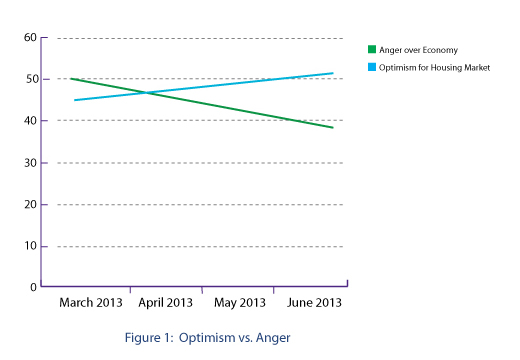

September 5, 2013—The Chicago Booth/Kellogg School Financial Trust Index issued today finds that, as home prices rise across the U.S., 51 percent believe property values will continue to increase over the next 12 months. The report also finds that only 39 percent are angry over the economy—down from 50 percent since last quarter.

"This is the lowest point we’ve seen in the measure of anger since we started tracking in 2008,” said Paola Sapienza, co-author of the Financial Trust Index and the Merrill Lynch Capital Markets Research professor of finance at the Kellogg School of Management at Northwestern University. “In five years it has fluctuated as high as 63 percent but never below 47 percent, so this is really a significant drop." Despite positive indicators, overall trust in the economy fell to 24 percent, a three-point slip since last quarter.

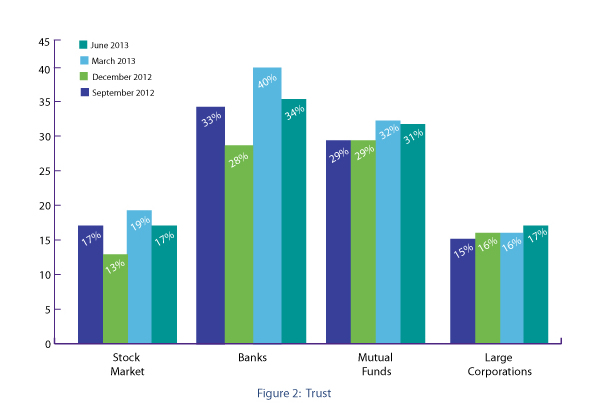

“The primary factor in this decrease is attitudes toward the stock markets and banks,” said Luigi Zingales, co-author of the Financial Trust Index and Robert C. McCormack Professor of Entrepreneurship and Finance and the David G. Booth Faculty Fellow at the University of Chicago Booth School of Business. The Chicago Booth/Kellogg School Financial Trust Index measures public opinion over three-month periods to track changes in attitude. Today’s report is the 19th quarterly update and is based on a survey conducted in June 2013. |

|||||