| About |

| The Results Wave 28 Wave 27 Wave 26 Wave 25 Wave 24 Wave 23 Wave 22 Wave 21 Waves 11-20 Waves 1-10 |

| Working Paper Series |

| Related Research |

| Authors |

| Sponsors |

| FAQ |

| Contact |

| Press Room |

|

The Results: Wave 18

May 31, 2013—The Chicago Booth/Kellogg School Financial Trust Index finds that trust in America’s financial system has reached 27 percent, its highest level reported since 2008 at the beginning of the economic crisis. This is a five-point increase from the last Index issued in December 2012. Despite the increase in trust, the report also finds that half of Americans say they are angry about the current economic situation.

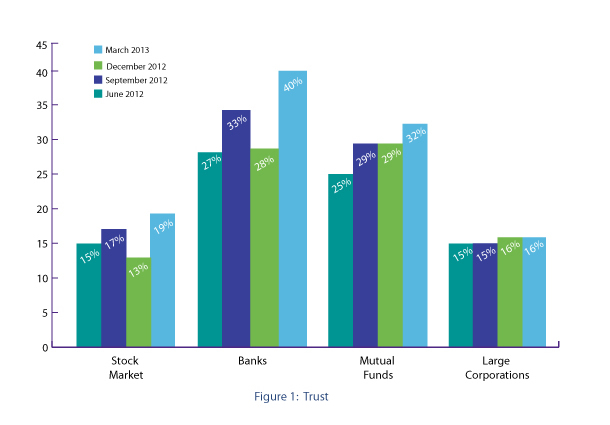

“The driving factor of this increase is trust towards the stock markets and banks,” said Luigi Zingales, co-author of the Financial Trust Index and Robert C. McCormack Professor of Entrepreneurship and Finance and the David G. Booth Faculty Fellow at the University of Chicago Booth School of Business. Trust in banks soared to 40 percent in the latest survey from 28 percent in March, while trust in the stock market rose to 19 percent from 13 percent. However, 52 percent of people now consider the stock market overvalued, while 19 percent say it is undervalued. “On the housing front, the survey also found 46 percent of people expect home prices to rise in the next 12 months,” said Paola Sapienza, co-author of the Financial Trust Index and the Merrill Lynch Capital Markets Research professor of finance at the Kellogg School of Management at Northwestern University. “This is up from 40 percent in the December 2012 Index.”

The Chicago Booth/Kellogg School Financial Trust Index measures public opinion over three-month periods to track changes in attitude. This report is the 18th quarterly update and is based on a survey conducted in March 2013. ABOUT THE SURVEY: On a quarterly basis, the Financial Trust Index captures the amount of trust that Americans have in the institutions in which they can invest their money. The survey is conducted by Social Science Research Solutions (SSRS) as part of their weekly national telephone survey, EXCEL. In the most recent wave, a total of 1,012 individuals were surveyed by live interviewers (not IVR) March 20 to March 27, 2013. The institutions considered in the survey are banks, the stock market, mututal funds and large corporations. |

|||||