| About |

| The Results Wave 28 Wave 27 Wave 26 Wave 25 Wave 24 Wave 23 Wave 22 Wave 21 Waves 11-20 Waves 1-10 |

| Working Paper Series |

| Related Research |

| Authors |

| Sponsors |

| FAQ |

| Contact |

| Press Room |

|

The Results: Wave 15

Paola Sapienza and Luigi Zingales1 CHICAGO (July 24, 2012) – The latest Chicago Booth/Kellogg School Financial Trust Index finds that only 21 percent of Americans trust the financial system, the lowest point on record since March 2009. According to the June 2012 report issued today, this decrease was largely driven by a drop in trust of national banks.

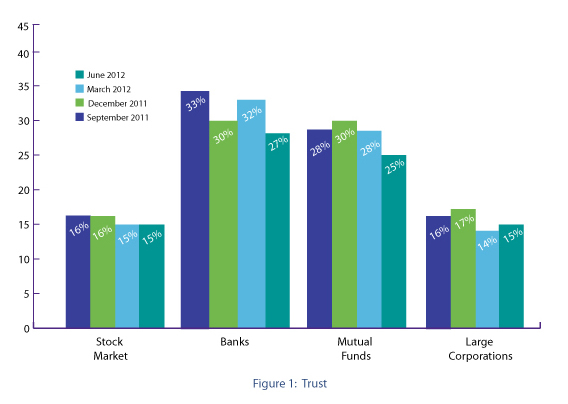

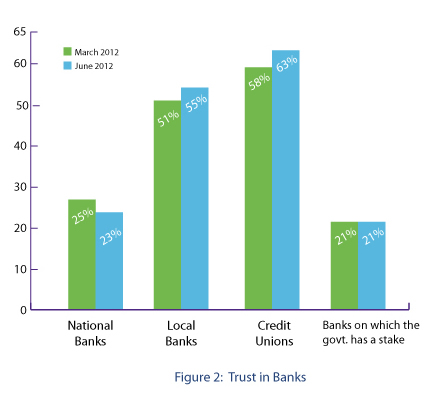

The Index measures public opinion over three-month periods to track changes in attitudes. Today’s report is the 15th quarterly update and is based on a survey conducted in June 2012. The previous survey (March 2012) showed that 22 percent of the population trusted the financial system. “Trust in banks has collapsed,” said Paola Sapienza, co-author of the Financial Trust Index. “Since last quarter’s issue of the Financial Trust Index, trust in banks has fallen five percentage points to a low of 27 percent. It’s worth noting that this data was collected in late June, so this drop could be reflective of consumer attitudes toward the news about JP Morgan’s multi-billion hedging losses announced in late spring.” Trust in national banks fell to 23 percent in the June 2012 report, from 25 percent in March. Trust in local banks increased to 55 percent from 51 percent, and trust in credit unions also increased, rising to 63 percent from 58 percent.

“This suggests that the national banks may be ‘too big to trust,’ whereas there is still a relatively high level of trust in banks at the community level,” said Luigi Zingales, co-author of the Financial Trust Index. Other findings from this quarter’s Financial Trust Index include:

ABOUT THE SURVEY: On a quarterly basis, the Financial Trust Index captures the amount of trust that Americans have in the institutions in which they can invest their money. The survey is conducted by Social Science Research Solutions (SSRS) as part of their weekly national telephone survey, EXCEL. In the most recent wave, a total of 1,029 individuals were surveyed by live interviewers (not IVR) from June 20 to June 28, 2012. The institutions considered in the survey are banks, the stock market, mutual funds and large corporations. |

|||||||