|

Paola Sapienza and Luigi Zingales1

CHICAGO (January 26, 2012) – The latest issue of the Chicago Booth/Kellogg School Financial Trust Index finds that only 23 percent of Americans say they trust the country’s financial system. And, trust for banks continues to slide downward.

“We are continuing to report relatively low trust overall, hovering at the same level as our last quarterly report and as low as the earliest months of the economic crisis. In particular, trust in banks has continued to fall – now at 30 percent from 39 percent in June 2011,” said Paola Sapienza, co-author of the Financial Trust Index, a quarterly look at trust in America’s financial system. She is also the Merrill Lynch Capital Markets Research professor of finance at the Kellogg School of Management at Northwestern University.

Percentage of people trusting various components that comprise the Financial Trust Index.

|

|

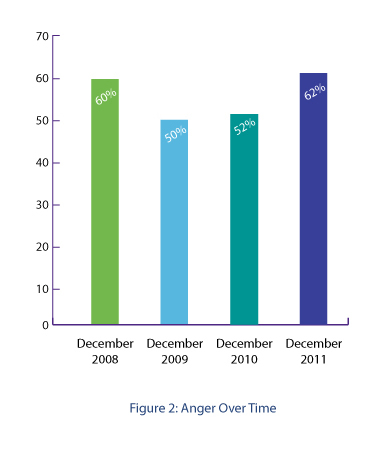

Also, 62 percent of people surveyed described themselves as angry or very angry about the current economic situation. “This is the highest level of anger we’ve measured since March 2009,” said Sapienza. “In an election year, this certainly indicates the importance of the economy to the political agenda.”

Percentage of people who say they are angry or very angry about the current economic situation. |

|

The Chicago Booth/Kellogg School Financial Trust Index measures public opinion over three-month periods to track changes in attitude. Today’s report is the 13th quarterly update and is based on a survey conducted in December 2011.

Comparing Opinions: Average Americans vs. Economists

To take a closer look at several finance and economic policy questions, this issue of the Financial Trust Index also compared public opinion to the opinions of the Chicago Booth IGM Economic Experts Panel, a panel of distinguished economists with a keen interest in public policy from the major areas of economics.

“In this wave we wanted to measure attitudes toward economic policy among average Americans – and the degree to which economists agreed or didn’t agree,” said Luigi Zingales, co-author and the Robert R. McCormack Professor of Entrepreneurship and Finance at the University of Chicago Booth School of Business. “Overall, what we found was a high level of contrast.”

- Ability to Predict the Stock Market: Financial Trust Index survey respondents appear more confident than economic experts about one’s ability to predict the stock market. In response to the statement, “Very few investors, if any, can consistently make accurate predictions about whether the price of an individual stock will rise or fall on a given day,” 64 percent of economists strongly agreed whereas only 54 percent of the Index sample agreed. Respondents with at least a college degree answered more closely to economists (70 percent agree), as did people who make more than $75,000 a year (63 percent agree).

- Top marginal tax rate: While 66 percent of respondents agree with the statement, “Permanently raising the federal tax rate by one percentage point for those in the top income tax bracket would increase federal tax revenue over the next 10 years,” a full 100 percent of economists agree. The survey highlights a sharp difference between Republican and Democrats supporters; only 50 percent of Republicans surveyed agree that increasing the top tax rates will increase tax revenues, versus 80 percent of Democrats. This difference exists in spite of the fact that this statement is factual, not political. Indeed, all economists, regardless of their political orientation, agree with it.

- Eliminating tax deductions: Eighty-five percent of economists agree that “Eliminating tax deductions on mortgages would lead to better financing by individuals.” By contrast, 35 percent of the Index sample agreed. Notably, agreement is larger in households with lower incomes (41 percent) than those with higher incomes (23 percent).

- The “Buy American” mandate: The biggest dissonance between the Financial Trust Index respondents and the economists related to the effects of the “Buy American” mandate in the stimulus package. Nearly 75 percent of Index respondents agreed with the following statement: “Mandates that Federal government purchases should be ‘buy American’ have a significant positive impact on U.S. manufacturing employment.” By contrast, only 10 percent of economists on the panel agreed with this statement.

Despite Low Trust and Rising Anger, Index Finds Improved Expectations on Other Fronts

According to Sapienza and Zingales, Americans did report improved expectations in a few areas of the Index. For example, 50 percent of respondents said they believe a significant stock market drop is likely, down from a high of 55 percent in September 2011.

Respondents were asked, “In your opinion, what is the likelihood that the stock market will drop by more than 30 percent in the next 12 months?” |

|

Similarly, the percentage of people who think that house prices will drop in the next 12 months is 23 percent (compared to 33 percent in September 2011). And, 77 percent of respondents expect house prices to remain stable or increase, which is up from 67 percent in September 2011.

ABOUT THE SURVEY: On a quarterly basis, the Financial Trust Index captures the amount of trust that Americans have in the institutions in which they can invest their money. The survey is conducted by Social Science Research Solutions (SSRS) using ICR/International Communications Research’s weekly telephone poll service. As part of the most recent wave, a total of 1,050 individuals were surveyed from Dec. 14 to Dec. 20, 2011. The institutions considered in the survey are banks, the stock market, mutual funds, and large corporations.

1 Paola Sapienza is the Merrill Lynch Capital Markets Research Professor of Finance at the Kellogg School of Management at Northwestern University. Luigi Zingales is the Robert McCormack Professor of Entrepreneurship and Finance at the University of Chicago Booth School of Business. |

|