|

Paola Sapienza and Luigi Zingales1

CHICAGO (October 19, 2011) – With news headlines focused on Occupy Wall Street, falling household incomes, and President Obama’s low approval ratings, the latest findings of the Chicago Booth/Kellogg School Financial Trust Index paint a gloomy picture of attitudes toward America’s financial systems and economic climate.

“First, only 23 percent of those surveyed say they trust the country’s financial systems, down from 25 percent in our last report in June 2011. Also, nearly 60 percent of respondents in our survey said they are angry or very angry about the current economic situation – the highest level of anger we’ve found since the earliest months of the financial crisis,” said Luigi Zingales, the Robert R. McCormack Professor of Entrepreneurship and Finance at the University of Chicago Booth School of Business and co-author of the Financial Trust Index, a quarterly look at trust in America’s financial systems.

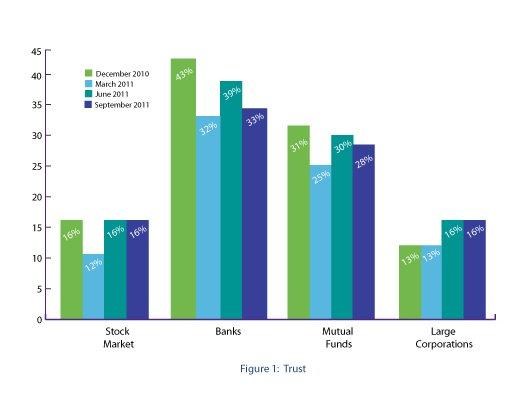

Percentage of people trusting various components that comprise the Financial Trust Index.

|

|

“The findings in this issue reflect what’s been reported in the news and demonstrate the fragility of trust many Americans still have in the institutions where they invest their money,” he added.

The Obama Effect

In addition, the Index found that two-thirds of Americans think the government effort to create new jobs should take priority over a deficit reduction. However, the researchers uncovered an interesting trend with regard to this data. In the survey, they asked half of the participants if they agree new jobs should be a priority over reducing debt. They primed the other half of the sample by prefacing the same question with: “Do you agree with President Obama that a government effort to create new jobs should take priority over a deficit reduction?”

“When we asked the question in the context of the president, we saw a large drop in support for new jobs among Republicans (to 28 percent from 39 percent), a moderate drop among Democrats (to 85 percent from 90 percent), and no change among independent voters (65 percent),” said Paola Sapienza, co-author and Merrill Lynch Capital Markets Research Professor of Finance at the Kellogg School of Management at Northwestern University. “Generally speaking, this suggests that people were inclined to change their position when we mentioned President Obama’s name, an outcome that may be consistent with his declining approval rating.”

The Gender Gap

Sapienza noted that this was particularly true among female respondents. Seventy percent of women primed with the president’s name showed a preference for job creation over deficit reduction, as compared to 77 percent in the other half of the sample when President Obama was not mentioned. Additionally, the percentage of female respondents who said they do not trust the government reached 55 percent, 8 percentage points higher than in March 2009. And, among Democrats, more women are disappointed by the current economic situation than men.

“These findings indicate just how pressing of a political issue the economy is likely to be as the presidential campaign gets underway, within and across party and gender lines,” said Sapienza.

“Worrisome levels of trust” in the Financial Trust Index

The Chicago Booth/Kellogg School Financial Trust Index measures public opinion over three-month periods to track changes in attitude. Today’s report is the 12th quarterly update, looking at the period covering September 2011. According to Sapienza and Zingales, trust has reached “worrisome levels” on many fronts; in several areas measured in the Index, trust is on par with levels reported in the earliest days of the financial crisis. Other key findings include:

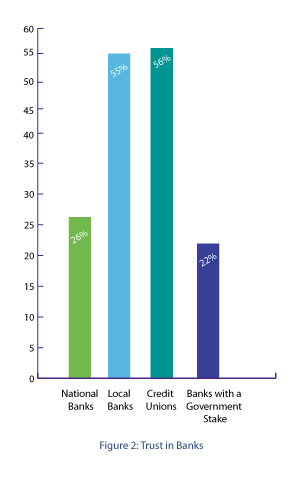

- Trust in Banks Drops – Trust in banks has fallen to 33 percent since June 2011 (39 percent). The researchers noted a disparity in trust between national banks (26 percent) and banks in which the government has a stake (22 percent), versus local banks (55 percent) and credit unions (56 percent).

Overall trust in banks has fallen to 33 percent in September 2011, compared to 39 percent in June 2011. |

|

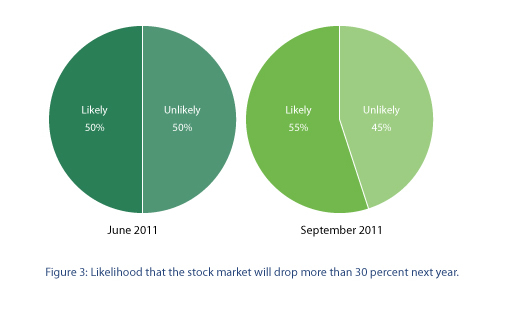

- Stock Market: Fear of Falling – Fifty-five percent of respondents said they believe a significant stock market drop is likely – the highest level since the first issue of the Index in December 2008.

Respondents were asked, “In your opinion, what is the likelihood that the stock market will drop by more than 30 percent in the next 12 months?” |

|

- Uncertainty on the Housing Front – The percentage of people who think that house prices will drop in the next 12 months is 33 percent – the highest since March 2009 and an increase of 3 percentage points compared to three months ago.

- Attention in the U.S. about the Euro – Only 39 percent of Americans are worried that the possible break-up of the euro may have an impact on the U.S. economy.

ABOUT THE SURVEY: On a quarterly basis, the Financial Trust Index captures the amount of trust that Americans have in the institutions in which they can invest their money. The survey is conducted by Social Science Research Solutions (SSRS) using ICR/International Communications Research’s weekly telephone poll service. As part of the most recent wave, a total of 1,020 individuals were surveyed from Sept. 21 to Sept. 28, 2011. The institutions considered in the survey are banks, the stock market, mutual funds, and large corporations.

1 Paola Sapienza is the Merrill Lynch Capital Markets Research Professor of Finance at the Kellogg School of Management at Northwestern University. Luigi Zingales is the Robert McCormack Professor of Entrepreneurship and Finance at the University of Chicago Booth School of Business. |

|