| About |

| The Results Wave 28 Wave 27 Wave 26 Wave 25 Wave 24 Wave 23 Wave 22 Wave 21 Waves 11-20 Waves 1-10 |

| Working Paper Series |

| Related Research |

| Authors |

| Sponsors |

| FAQ |

| Contact |

| Press Room |

|

The Results: Wave 11

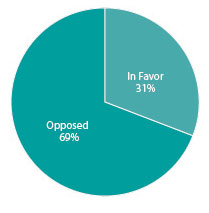

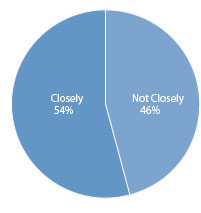

Paola Sapienza and Luigi Zingales1 CHICAGO (July 20, 2011) – While debate about the debt ceiling rages in Washington, the Chicago Booth/Kellogg School Financial Trust Index released today finds that 69 percent of Americans with a view on the issue are against raising the debt ceiling, with the remaining 31 percent in favor. “This new report explores attitudes about the debt ceiling among everyday Americans – how much people have thought about the implications of the issue, as well as how political affiliation may affect their stance,” said Paola Sapienza, professor of finance at the Kellogg School of Management at Northwestern University and co-author of the Financial Trust Index, a quarterly look at trust in America’s financial systems. Although the majority of survey participants with a position on the debt ceiling oppose raising it, the Index finds that 46 percent of people surveyed did not have an opinion on the issue at all. Additionally, it found that nearly half of the country is not following the debt ceiling debate closely, despite its prominence in the media.

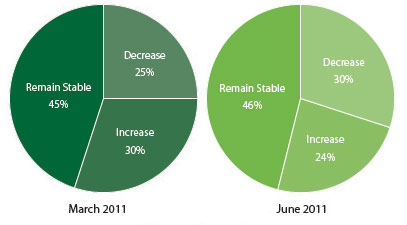

To prime some of the respondents to think about potential financial consequences of not raising the debt ceiling, half were asked who the government should stop paying first if the debt ceiling is not raised. The majority of respondents (45 percent) said U.S. Treasury debt holders, followed by 38 percent saying non-military government employees. Only 10 percent would cut back on paying the Army and 7 percent on social security recipients. “Although half of the participants were forced to think about tough economic choices – that not raising the debt ceiling may eventually force the United States to default on its obligations – this didn’t influence their stance on the issue,” said Luigi Zingales, co-author and professor of entrepreneurship and finance at the University of Chicago Booth School of Business. “In fact, what we found is that support or opposition was correlated with political affiliation, reinforcing the role of politics in driving opinion in this debate.” Interestingly, Sapienza and Zingales noted that the majority of those in favor of raising the debt ceiling are Democrats, while those against doing so are more likely to be Republicans or Independents. Key Findings in the Financial Trust Index In addition to the data about the debt ceiling debate, this wave of research also finds that 25 percent of Americans trust America’s financial systems, an increase following a dip reported in the March 2011 report in which trust went to 20 percent in the days after Japan’s natural disasters and nuclear crisis, as well as a steep stock market drop. Now, trust has returned to levels similar to those in January 2011 (26 percent). Other key findings include:

ABOUT THE SURVEY: On a quarterly basis, the Financial Trust Index captures the amount of trust that Americans have in the institutions in which they can invest their money. The survey is conducted by Social Science Research Solutions (SSRS) using ICR/International Communications Research’s weekly telephone poll service. As part of the most recent wave, a total of 1,003 individuals were surveyed from June 15 to June 23, 2011. The institutions considered in the survey are banks, the stock market, mutual funds, and large corporations. 1 Paola Sapienza is a Professor of Finance at the Kellogg School of Management at Northwestern University and Luigi Zingales is the Robert McCormack Professor of entrepreneurship and finance at the University of Chicago Booth School of Business. |

|||||||||||